In today’s digital world, subscription-based services are common. While the convenience can’t be denied, they sometimes result in unexpected or even unauthorized charges. One such incident involved a $500 auto-renewal fee from Bluehost, which a customer successfully disputed. This article delves into the details of that experience, offering a clear, step-by-step breakdown of how the customer managed to get a full refund and what others can learn from it.

TLDR: A customer was charged $500 via an unexpected auto-renewal by Bluehost. Despite not receiving prior notice, they were initially denied a refund by customer service. By documenting their case, escalating the issue, and involving their credit card provider, they successfully obtained a full refund. This case serves as a cautionary tale and a roadmap for others facing similar challenges with online service providers.

The Unexpected Charge

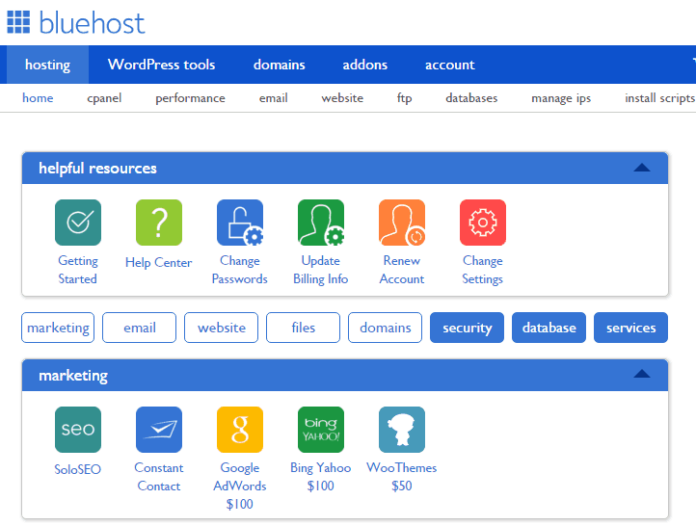

It started like this: A Bluehost customer—let’s call him John—received a credit card notification about a $500 charge. Surprised, John immediately logged into his Bluehost account and discovered that his web hosting plan, which he hadn’t used in over a year, had been auto-renewed.

John had not received any prior reminders about the upcoming renewal, nor did he remember agreeing to such a high-priced plan renewal. Alarmed and frustrated, he knew he had to act fast if he wanted his money back.

Initial Reaction and Contacting Bluehost

John’s first step was to reach out to Bluehost via their live chat customer support. Here’s a brief playback of what happened:

- The agent acknowledged the charge but claimed it was non-refundable as per company policy.

- They insisted that the account had “auto-renew” enabled and that it was the customer’s responsibility to disable it.

- When John asked for a copy of the renewal notice, he was told that reminders may not always be sent if there’s an email communication error.

Fully aware of his rights and unwilling to accept the unfair charge, John decided to escalate the situation.

Documenting the Case

John began by gathering evidence to support his position. If you’re ever in a similar situation, make sure to collect the following:

- Transaction Record: Save the bank or credit card alert regarding the unauthorized charge.

- Customer Service Transcript: Copy and save all chats or emails with customer service.

- Account Settings Screenshots: Document the absence of any opt-in for auto-renew or missing renewal notifications.

- Email Logs: Show that no renewal notification was sent before the charge occurred.

This detailed documentation helped John build a persuasive case, making it clear there had been a lack of fair notification and possible misrepresentation on Bluehost’s part.

Filing a Formal Complaint with Bluehost

Refusing to give in after the live chat failed, John took the next logical step: submitting a formal written complaint to Bluehost support. In the letter, he clearly laid out:

- A timeline of events, including the unexpected charge

- Quoted terms from Bluehost’s own policies, emphasizing the lack of notification

- Attached all documentation as proof

- Requested a full refund and the cancellation of the renewal

He requested a response within 7 business days. Unfortunately, Bluehost responded with the same rigid stance: the charge was valid under their terms and did not qualify for a refund.

Involving the Credit Card Provider

When Bluehost wouldn’t budge, John took the next critical step—he initiated a dispute with his credit card provider. This turned out to be the turning point.

Here’s how credit card companies generally handle such disputes:

- They place a temporary hold on the transaction while investigating.

- They request a detailed written explanation and supporting documents from the cardholder.

- They give the merchant a chance to respond within a specified timeframe.

John submitted everything he’d prepared. He emphasized the lack of authorization or advance notice, the absence of a service being used, and Bluehost’s refusal to refund despite repeated requests.

The Resolution

Roughly four weeks after the dispute was launched, John received a notice from his credit card provider: the dispute had been resolved in his favor. The $500 charge was reversed in full, and the temporary hold was lifted from his account.

This wasn’t just good news—it was a validation that consumers do have rights when dealing with potentially exploitative billing practices.

Key Takeaways and Lessons Learned

John’s case sheds light on several important principles and best practices for anyone using online services, particularly those that operate on a subscription basis:

- Always Check Auto-Renew Settings: As soon as you sign up for a service, find out if auto-renew is enabled by default and disable it if necessary.

- Set Calendar Reminders: Set your own reminders a few weeks before a service is due to renew.

- Monitor Emails Carefully: Make sure service providers have your correct email and that their emails aren’t going to spam.

- Keep Everything in Writing: Save chats, tickets, and receipts, as they are invaluable in the event of a dispute.

- Don’t Hesitate to Escalate: If a company refuses to refund you, go through your bank or credit card provider.

Final Thoughts

What happened to John could happen to anyone. Subscription-based models count on users forgetting to cancel. Worse, some providers make it difficult to unsubscribe or issue refunds even when customers complain almost immediately after being charged.

John’s story is an encouraging example of how perseverance, documentation, and following the proper escalation channels can lead to a successful outcome—even when the odds seem stacked against the individual.

Let this case be a reminder: You have more power than you think. And companies need to hear when you’ve been wronged.